The organization sells medical equipment, as well as consumables and spare parts for it. For the first time in 10 years, an inventory of inventory balances in warehouses was carried out, which revealed expired goods, defective goods (illiquid) and shortages of goods. The inventory results are formatted accordingly. Is it possible to take into account expenses for the purpose of calculating income tax for expired goods, defective goods (illiquid), and shortages of goods identified during inventory?

Tax accounting of shortages of goods

According to the provisions of Art. 252 of the Tax Code of the Russian Federation, when determining the tax base for income tax, organizations reduce the income received by the amount of expenses incurred, with the exception of expenses not taken into account for tax purposes on the basis of Art. 270 Tax Code of the Russian Federation.

Expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred (incurred) by the taxpayer.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

Documented expenses mean expenses supported by documents drawn up in accordance with the legislation of the Russian Federation.

Subclause 2, clause 7, art. 254 of the Tax Code of the Russian Federation provides that losses from shortages and (or) damage during storage and transportation of inventories within the limits of natural loss norms approved in the manner established by Decree of the Government of the Russian Federation of November 12, 2002 N 814 are equated to material costs.

However, if the identified shortage cannot be qualified as a natural loss of goods, the norms of paragraphs. 2 clause 7 art. 254 of the Tax Code of the Russian Federation do not apply (see also Resolution of the Ninth Arbitration Court of Appeal dated November 21, 2012 N 09AP-26757/12).

According to paragraphs. 5 p. 2 art. 265 of the Tax Code of the Russian Federation, losses received by a taxpayer in the reporting (tax) period in the form of a shortage of material assets in production and warehouses, at trading enterprises in the absence of perpetrators, as well as losses from theft, the perpetrators of which have not been identified, are equated to non-operating expenses. The fact of the absence of guilty persons must be documented by an authorized government body (see letters of the Ministry of Finance of Russia dated December 16, 2011 N 03-03-06/4/149, dated 08/03/2011 N 03-03-06/1/448, dated 20.06. 2011 N 03-03-06/1/365, dated 04/28/2010 N 03-03-06/1/300, dated 09/11/2007 N 03-03-06/1/658, resolution of the Seventeenth Arbitration Court of Appeal dated 18.01. 2012 N 17AP-13188/11).

At the same time, specialists from the financial department explain that the fact that the perpetrators are absent is confirmed by a copy of the resolution to suspend the preliminary investigation (clause 2 of Article 208, clause 13 of clause 2 of Article 42 of the Criminal Procedure Code of the Russian Federation).

The date of recognition of a loss from a shortage of material assets in the absence of perpetrators is the date the investigator issues the corresponding resolution (letter from the Ministry of Finance of Russia dated 03.08.2011 N 03-03-06/1/448, dated 20.06.2011 N 03-03-06/1/ 365, dated 08/27/2010 N 03-03-06/4/81, dated 06/08/2009 N 03-03-05/103, dated 05/02/2006 N 03-03-04/1/412, Ministry of Taxes of Russia dated 06/08. 2004 N 02-5-10/37).

Taking into account the position of the Ministry of Finance of Russia, it can be assumed that the tax authorities may not accept for tax purposes losses from a shortage of material assets in the absence of such a resolution, if the organization did not take any measures to identify the perpetrators (resolution of the Federal Antimonopoly Service of the Moscow District dated March 11, 2009 N KA- A40/1255-09).

If the organization did not contact the authorized government bodies regarding the fact of theft, then in order to avoid disputes with the tax authorities, it is advisable not to take into account the shortage of goods for profit tax purposes.

At the same time, there are examples of court decisions, according to which it is possible to confirm the absence of those responsible for the shortage with other documents containing the necessary information, in particular a certificate or letter from the Internal Affairs Directorate (resolutions of the Ninth Arbitration Court of Appeal dated July 3, 2012 N 09AP-15010/12, N 09AP-15430 /2012, FAS Moscow District dated November 9, 2007 N KA-A40/10001-07, FAS West Siberian District dated August 7, 2007 N F04-5161/2007(36812-A46-15)).

Therefore, if the organization did not contact the authorized government bodies regarding the fact of theft, then in order to avoid disputes with the tax authorities, it is advisable not to take into account the shortage of goods for profit tax purposes.

Write-off in tax accounting of expired and illiquid goods (goods with defects)

It should be noted that Ch. 25 of the Tax Code of the Russian Federation does not contain special rules that would allow taking into account the cost of expired (illiquid) goods when determining the tax base for income tax.

At the same time, the list of both non-operating and other expenses associated with production and (or) sales is open and allows you to reduce the tax base for income tax for other economically justified expenses (clause 49 of article 264 of the Tax Code of the Russian Federation, clause 20 Article 265 of the Tax Code of the Russian Federation).

Therefore, if an organization justifies and documents the write-off of goods that are not suitable for sale, then their cost can be taken into account as part of other or non-operating expenses.

In our opinion, a reduction in the tax base for income tax by the amount of these goods is possible due to the fact that they were initially purchased for use in activities aimed at generating income.

Resolutions of the Constitutional Court of the Russian Federation dated 06/04/2007 N 366-О-П and 320-О-П explain that the validity of expenses taken into account when calculating the tax base must be assessed taking into account circumstances indicating the taxpayer’s intentions to obtain an economic effect as a result of real business or other economic activities. In this case, we are talking specifically about the intentions and goals (direction) of this activity, and not about its result, and the burden of proving the unreasonability of the taxpayer’s expenses rests with the tax authorities.

The arbitration judges came to a similar conclusion in the resolution of the Ninth Arbitration Court of Appeal dated November 7, 2012 N 09AP-29791/12: “Thus, the presence of defective goods does not mean that the applicant’s activities were not aimed at making a profit. Judicial practice proceeds from the fact that that in order to account for expenses for income tax purposes, the focus of the taxpayer’s activities on making a profit, and not on the result, is sufficient.”

In the resolution of the Federal Antimonopoly Service of the Ural District dated August 24, 2011 N F09-5075/11 in case N A60-42997/2010, it was noted that since goods whose shelf life subsequently expired were purchased to generate income, the costs of their acquisition are justified. Therefore, the taxpayer has the right to take them into account when calculating the tax base for income tax on the basis of paragraphs. 49 clause 1 art. 264 of the Tax Code of the Russian Federation as part of other expenses associated with production and sales.

A similar conclusion was formed in the resolution of the Federal Antimonopoly Service of the Moscow District dated 01.02.2008 N KA-A40/14839-07-2. At the same time, the courts established that the goods, which subsequently turned out to be defective due to defects and expiration dates, were purchased by the applicant precisely for the purpose of their further sale, that is, for operations related to making a profit; the appearance of defects is an objective consequence of the company carrying out entrepreneurial activities related to wholesale trade, that is, the sale of goods; The tax authority did not provide any evidence that the applicant’s products intended for destruction were subsequently sold (see also resolution of the Federal Antimonopoly Service of the Moscow District dated October 11, 2007 N KA-A41/10338-07).

The decision to reduce the tax base for income tax on the cost of goods written off due to expiration (unsuitable for sale due to the presence of irreparable defects) must be made by the organization independently.

It is worth noting that representatives of financial authorities have a different point of view. According to the opinion of the Ministry of Finance of Russia, expressed in letters dated 07/05/2011 N 03-03-06/1/397 and dated 06/07/2011 N 03-03-06/1/332, in the case of disposal (write-off) of illiquid (expired) goods, the costs for their acquisition and further liquidation cannot be considered as part of the extraction of income from business activities and, therefore, are not subject to accounting as expenses for profit tax purposes.

There are also court decisions on this issue that do not support the taxpayer. Thus, in the resolution of the Federal Antimonopoly Service of the East Siberian District dated December 24, 2008 N A10-2479/08-Ф02-6500/08, the court indicated that: “written-off goods - spare parts were purchased earlier for activities related to production and sales. That the fact that the product was not used or sold is not a basis for attributing its value, as a written-off illiquid product, to the company’s expenses.”

Due to the principle of freedom of economic activity (part one of Article 8 of the Constitution of the Russian Federation), the taxpayer carries out it independently at his own risk and has the right to independently and individually evaluate its effectiveness and expediency.

Taking into account the above, the organization must make the decision to reduce the tax base for income tax on the cost of goods written off due to expiration (unsuitable for sale due to the presence of irreparable defects).

In addition, we note separately that in cases where legislation imposes on the taxpayer the obligation to destroy (dispose of) certain types of goods (in particular cosmetic products, confectionery products, medications, household chemicals), the costs of purchasing goods, as well as the costs of their disposal (destruction) can be taken into account as expenses that reduce the tax base for income tax. This position is set out in letters of the Ministry of Finance of the Russian Federation dated 07/04/2011 N 03-03-06/1/387, dated 03/05/2011 N 03-03-06/1/121, dated 04/15/2011 N 03-03-06/1/ 238 and the Federal Tax Service of the Russian Federation dated July 16, 2009 N 3-2-09/139.

The texts of the documents mentioned in the experts’ response can be found in the GARANT legal reference system.

Service experts talk about how to write off losses from irreparable manufacturing defects in the accounting and tax accounting of an organization that applies a general taxation system, as well as about documents confirming the occurrence of these irreparable losses Legal consulting GARANT Olga Samoiluk and Olga Monaco.

Based on orders received from customers, the organization (general tax regime) produces key fobs. For this purpose, blanks are purchased, onto which an image chosen by the customer is applied. To produce a batch of products, 1,100 pieces of blanks (materials) were purchased, all of which were released into production. During the production process, 100 pieces of blanks were damaged and cannot be used for further use. At the end of the month, there is no balance of work in progress in the organization’s accounting. How to reflect the write-off of losses from an irreparable manufacturing defect in accounting and tax accounting? What documents should be submitted?

In accordance with clause 38 of the Basic Provisions for planning, accounting and calculating the cost of products at industrial enterprises, approved by the Central Administration of the USSR, the State Planning Committee of the USSR, the State Committee for Prices of the USSR and the Ministry of Finance of the USSR 07/20/1970 N AB-21-D (hereinafter referred to as the Provisions), defects in production are products, semi-finished products, parts, assemblies that do not meet established standards or technical specifications in quality and cannot be used for their intended purpose or can be used only after correction.

In other words, there are two types of marriage:

Correctable;

Incorrigible (final).

Correctable defects are considered to be products, semi-finished products (parts and assemblies), which, after correction, can be used for their intended purpose and the correction of which is technically possible and economically feasible. In this case, final defects are considered to be products, semi-finished products, parts and assemblies that cannot be used for their intended purpose and the correction of which is technically impossible or economically impractical.

Based on the location of detection, defects are divided into internal, identified at the enterprise before sending products to consumers, and external, identified at the consumer during the assembly, installation or operation of the product.

Since in the situation under consideration, a defect was committed during the production process (after the materials were released into production) and defective products cannot be corrected, then, taking into account the above definitions, we can speak of an internal final defect.

Accounting

In accordance with instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 N 94n(hereinafter referred to as the Instructions) to account for losses from defects in production, including from internal final defects, account 28 “Defects in production” is used. Analytical accounting on account 28 is carried out for individual structural divisions, types of products, expense items, reasons and culprits of the defect.Costs for identified internal defects are reflected in the debit of account 28. In the situation under consideration, such costs include the cost of unfinished products recognized as irreparable defects.

According to the Instructions, amounts attributed to the reduction of losses from defects (for example, amounts to be withheld from those responsible for the defects), as well as amounts written off to production costs as losses from defects, are reflected in the credit of account 28.

Let us note that non-refundable amounts of losses from defects are recognized for accounting purposes as expenses for ordinary activities (clause 5 of PBU 10/99 “Expenses of the organization”). In this case, losses from defects are included in the costs of the production (accounts 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”), in the process of which the defect occurred. The specified operation to write off non-reimbursable losses from defects is carried out at the end of each month. As a rule, account 28 has no balance at the end of the month.

Clause 99 of the Regulations states that the amounts of non-reimbursable losses from defects are included in the cost of the product or type of work for which a defect is detected. In most cases, the inclusion of losses from defective products in the cost of work in progress is not allowed. An exception is for individual and small-scale production, provided that these losses relate to a specific order that has not been completed in production.

Taking into account the above, when accounting for internal final defects, the following entries are generated in accounting:

Debit 28 Credit 20

The cost of products recognized as final defects is included in the cost of defects.

If an employee is identified who has committed a defect during the production process, then the cost of defective products can be charged to his account in the manner prescribed by labor legislation (Articles 238, 246-248 of the Labor Code of the Russian Federation):

Debit 73 “Settlements with personnel for other operations” Credit 28

The cost of defective products is charged to the account of the guilty employee.

At the end of the month, non-reimbursable losses from defects (account 28 balance) are reflected in accounting as follows:

Debit 20 Credit 28

Non-reimbursable losses from defects are included in the costs of main production;

Debit 43 “Finished products” Credit 20

Non-refundable losses from defects are included in the cost of products of good quality produced in the reporting month.

Income tax

In accordance with paragraphs. 47 clause 1 art. 264 of the Tax Code of the Russian Federation, losses from defects are included in other expenses associated with production and sales.Let us note that the norms of the Tax Code of the Russian Federation do not establish any special restrictions (standards) regarding the accounting of these expenses. Accordingly, subject to the fulfillment of the general criteria for recognizing expenses for the purposes of Chapter 25 of the Tax Code of the Russian Federation (clause 1 of Article 252 of the Tax Code of the Russian Federation): economic justification and documentary evidence of the costs incurred, non-reimbursable losses from defective products can be fully taken into account in expenses by the manufacturing organization .

The same position is shared by specialists from official bodies (see, for example, letters from the Ministry of Finance of Russia dated July 4, 2011 N 03-03-06/1/387, Federal Tax Service of Russia for Moscow dated June 18, 2009 N 16-15/061671).

A similar position is reflected in arbitration practice (see, for example, decisions of the Ninth Arbitration Court of Appeal dated July 23, 2010 N 09AP-15374/2010, FAS North-Western District dated March 13, 2009 N A56-21158/2008, FAS Moscow District dated February 1. 2008 N KA-A40/14839-07-2).

Depending on the norms of the organization’s accounting policy for tax accounting purposes, other expenses associated with production and (or) sales can be included in both indirect and direct expenses (clause 1 and clause 2 of Article 318 of the Tax Code of the Russian Federation ).

Let us remind you that indirect expenses are fully included in the expenses of the current reporting (tax) period (clause 2 of Article 318 of the Tax Code of the Russian Federation). Direct expenses form the tax base during the period of sale of products, in the cost of which these expenses are taken into account (clause 2 of Article 318 of the Tax Code of the Russian Federation).

Thus, in the accounting policy of the organization for tax accounting purposes, it is necessary to consolidate the procedure for accounting for the costs of defective products, in particular, to develop a methodology for calculating the cost of defective products.

VAT

In paragraph 3 of Art. 170 of the Tax Code of the Russian Federation contains a closed list of cases in which “input” VAT, previously legally accepted for deduction, is subject to restoration.Let us note that this norm does not contain such a basis for the restoration of “input” VAT as the write-off of defective products that are not suitable for further use (without identifying the guilty parties).

At the same time, according to the official authorities, the “input” VAT in the situation under consideration is subject to restoration in the period of writing off the defective one, since it will not be used to carry out operations recognized as objects of VAT taxation (see, for example, letters of the Ministry of Finance of Russia dated July 4, 2011 N 03-03-06/1/387, dated 01.11.2007 N 03-07-15/175, dated 14.08.2007 N 03-07-15/120).

Judicial practice today is developing in favor of organizations (see, for example, decisions of the Ninth Arbitration Court of Appeal dated March 30, 2012 N 09AP-6551/12, FAS Volga District dated April 17, 2009 N A55-11139/2008, FAS North Caucasus District dated 08/10/2009 N A32-5096/2007-12/27).

In addition, the Supreme Arbitration Court of the Russian Federation, in decision dated October 23, 2006 N 10652/06, indicated that, in accordance with Art. 23 of the Tax Code of the Russian Federation, the taxpayer is obligated to pay legally established taxes. Consequently, the obligation to pay to the budget the amount of VAT previously legally accepted for deduction must be directly and directly provided for by law.

At the same time, taking into account the above clarifications of the Russian Ministry of Finance, we believe that the decision not to restore “input” VAT when writing off defective products may very likely lead to disagreements with the tax authorities.

Document flow

The occurrence of non-compensable losses from internal defects (in the absence of perpetrators) can be confirmed by drawing up the following documents:Act on identifying an irreparable marriage;

Act on the destruction of defective products, etc.

Let us remind you that when developing document forms, you must comply with the requirements established for primary documents by the norms of Art. 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Law N 402-FZ).

In addition to the mandatory details of the primary document established in Part 2 of Art. 9 of Law N 402-FZ, it is advisable to indicate in the marriage certificate:

Name of the rejected product, its nomenclature, technical number;

Description of the nature of the marriage and its reasons;

Number of rejected products;

Cost of defective products, etc.

The texts of the documents mentioned in the experts’ response can be found in the legal reference system

Defects in production are considered to be products, semi-finished products, parts, work that do not meet the established standards or technical conditions in quality. They will not be able to be used for their intended purpose. Although sometimes this is possible, but only after correction. Let's look at several examples of accounting for and correcting manufacturing defects in the 1C program: Enterprise Accounting 8 edition 3.0.

Manufacturing defects can be of several types: correctable or irreparable, and depending on the moment of detection, they are divided into internal or external. In this article we will dwell in detail on various examples of working with a fixable marriage.

To account for defective products, account 28 “Defects in production” is used. The debit of account 28 collects the costs of identified defects, and the credit reflects the amounts for writing off defective products.

In our example, the organization “Tables and Chairs” is engaged in the production of tables and chairs for their subsequent sale.

Let's start with the accounting policy settings. Here you must indicate that the costs will be taken into account on account 20.01. We check the box that our organization produces products.

If the defect was made during the production process, the products have not yet been transferred to the warehouse, the guilty person has been identified (deduction for the defect or additional payment for its correction is not made) and no additional materials are required to correct the defect, but only the labor resources of the employee, then The program should not perform any operations to reflect this situation.

Let's consider a situation where a correctable defect was discovered, but the culprit was not identified.

The defect was corrected by an employee, who was additionally paid for this. No additional materials were used.

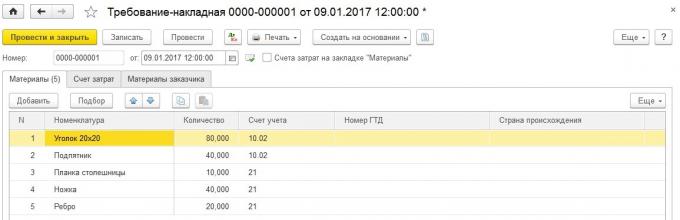

For a better understanding, we will describe the entire production process, starting with the transfer of materials using the “Requirement-Invoice” document. We indicate the necessary materials for making the table.

Cost account – 20.01, item group – “Tables”, cost item – “Material expenses”.

We carry out the document. We see that our semi-finished products and materials were written off to the account on January 20.

Product output is reflected in the document “Production Report for a Shift”. We indicate that we produced 10 tables.

Finished products are reflected in the debit of account 43.

Now, let’s say one table has a defect, it needs to be corrected without the use of additional materials. The correction will be carried out by employee M. O. Kovalev, payment for this work is 2000 rubles. We create an additional accrual for him.

Let’s call the accrual “Payment for correction of defects.” We are creating a new way for it to be reflected in accounting – “Correction of defective products.” We indicate the accounting account – 28 “Defects in production”.

If we look at the document entries, we will see that the accrual of wages and the accrual of contributions to M. O. Kovalev are debited to account 28.

Let's generate a report "Turnover balance sheet" for account 28 and see that our expenses were collected on this account.

Next, you need to write off the costs of defects for the main production; for this we will use the “Operation” document. Debit – account 20.01, credit – 28, item group – “Tables”, amount – 2604 rubles.

Let's create the balance sheet for account 28 again and see that it is closed.

We close the month, select “References-calculations”, then the report “Cost calculation”.

The report shows that when forming the cost price, expenses for defects were included, and the article “Losses from defects” appeared in the amount of 2,604 rubles.

Let's consider the second example: an external and correctable marriage. Our organization produced the table and sold it to the buyer. The buyer discovered defects in the table; they were found to be correctable under warranty. To correct the defect, additional material and transport services are required to travel to the buyer. The employee was also paid for correcting the defect.

In this example, two situations are possible: our organization creates a reserve for warranty repairs or does not create it. Let's look at both.

We create a reserve for warranty repairs, deducting 3,000 rubles monthly.

Posting to debit 20.01 “Main production” and credit 96.09 “Other reserves for future expenses.”

I would like to draw your attention to the fact that these reserves will be taken into account when determining the cost of production.

On the “Cost Account” tab we indicate account 28, that is, we will write off the costs to “Defects in production”.

We look at the movement of the document: the materials were written off to account 28.

We reflect the costs of transportation services for an employee to travel to the buyer. Let's use the document “Receipt of services”.

We fill out the cost accounts, indicating the 28th account.

We look at the movements and see that transportation costs are also included in account 28.

We charge additional payment to employee Petrenko S.V. for warranty repairs, we indicate the accrual previously created by us - “Payment for correction of defects”.

Let's turn to the "Account Card" report for account 28. Let's look at the costs that were collected on it. The total cost is 1852 rubles.

Now we use our first option and write off expenses against the reserve. We create a document “Operation” - debit – account 96.09, credit – account 28.

We close the month and open the “Cost calculation” report. We do not see marriage expenses in the report, since they were repaid from the reserve.

The second situation: we do not create a reserve for warranty repairs, so expenses must be written off to account 20.01 “Main production” using the “Operation” document.

We form the SALT for account 28 and see that it has also closed.

We close the month and open the “Cost calculation” report. In this option, we do not create a reserve for warranty repairs; in fact, that is why we do not see this article in the report. In this example, the article “Losses from defects” appeared, which was taken into account when determining the cost of production.

Now let's look at marriage in the provision of services.

Let’s assume that our organization also provides furniture repair services.

Let's turn to the accounting policy and check the appropriate box.

We will hire an employee who will carry out the repairs. Let’s create a new accrual for it - “Payment by salary (repair)”, we will also create a new method of reflection - “Furniture repair”, we will indicate the account as 20.01, we will create a new item group, let’s call it “Furniture repair services”.

The organization "Tables and Chairs" provides services to the buyer for repairing furniture walls. Our organization used materials - screws, the rest of the materials were provided by the customer. Later, the client filed a claim for repair services. The organization must eliminate the deficiencies free of charge to the customer. This required additional materials: again screws and door handles.

We reflect the transfer of materials with the document “Demand-invoice”.

We indicate the cost account as 20.01, the item group – “Furniture repair services.”

We look at the postings, the materials are written off to the debit of the account on January 20.

We reflect the implementation of services to the customer.

We look at the movement of the document.

We pay salaries to employees. Let's look at the movements. Our repairman received a salary, which is reflected in account 20.01 and the nomenclature group - “Furniture repair services.”

We close the month, look at the generation of the “Cost Cost Calculation” report. This certificate does not calculate the cost of services, but forms the actual cost of production.

We indicate the cost account - 28 “Defects in production”.

The materials are written off to the debit of account 28. We will generate the “Account Card” report for account 28. Here we see the costs that are collected on this account to correct the defect.

We again create account card 28, we see that the expenses for calculating salaries and contributions have been added here.

The total cost was 1951 rubles. We need to write them off as the debit of account 20.01. We considered a similar operation earlier.

Let's look at the balance sheet: for account 20 all expenses are closed, for account 28 it is the same.

We close the month, generate a certificate-calculation “Cost cost calculation” and see that the actual cost has increased by the amount of losses from defects.

I would like to note that when correcting a defect, it is not necessary to reflect the fact of the provision of these services in the “Sales of Services” document.

Any production is, to a greater or lesser extent, accompanied by the occurrence of defects. Therefore, it is important to know how to organize correct accounting of defects in production.

If the received products or parts (work performed) do not comply with the norms, standards, technical conditions established by the enterprise and cannot be used for their intended purpose or can be used only after corrective corrections, then this is considered a manufacturing defect. Losses arising from marriage must be correctly taken into account in accounting.

Types of defects in production:

- correctable and incorrigible;

- internal and external.

Accounting for correctable marriage

To account for losses from defects, accounting account 28 is used.

If a defect resulting from the production process can be corrected, then it is necessary to determine the cost of correcting the defective product. To do this, the debit of account 28 collects all costs caused by the correction, this could be:

- wages of workers restoring defective products (posting D28 K70), (D28 K69),

- additional raw materials, materials (D28 K10) or semi-finished products (D28 K21),

- services of third parties (D28 K60).

1) Depending on the nature of the defects, marriage is divided into correctable and irreparable (final).

Non-refundable amounts of losses from defects are included in the cost of those types of products for which defects are detected. If in the period in which a defect was detected, this type of product was not produced, then the amount of losses from defects is distributed by type of product as general production expenses.

The cost of internal irreparable defects, subject to reflection on account 28 “Defects in production”, is determined by the amount of costs for the manufacture of defective products, which includes:

· cost of raw materials used;

· labor costs;

· corresponding amounts of unified social tax;

· expenses for maintenance and operation of equipment;

· part of general production costs;

· other costs associated with the manufacture of defective products.

To calculate the cost of the final defect, you must perform the following steps:

1. calculate the costs of manufacturing defective products;

4. determine the amount of losses from the final marriage.

Accounting for irreparable internal defects is documented by accounting entries:

|

Account correspondence |

||

|

Debit |

Credit |

|

|

The cost of defective products is written off |

||

|

Defective products are accepted for accounting at the price of possible use |

||

|

Amounts to be recovered from those responsible for the marriage have been accrued |

||

|

Amounts to be recovered from suppliers of defective materials have been accrued |

||

|

Losses from defects are included in the cost of production |

||

Example 1.

During production, an irreparable defect in a batch of products was identified, the cause of which was the use of low-quality materials. The costs of manufacturing defective products were:

The cost of materials used is 25,000 rubles;

Salary – 15,000 rubles;

The amount of unified social tax is 3,900 rubles;

The share of general production costs is 7,500 rubles.

The possible sale price of defective products is 20,000 rubles.

A claim was filed against the supplier of low-quality materials; the amount claimed for collection is 10,000 rubles.

|

Account correspondence |

Amount, rubles |

||

|

Debit |

Credit |

||

|

The cost of defective products is reflected (25,000 + 15,000 + 3,900 + 7,500) |

|||

|

Defective products are accepted for accounting at the price of possible sale |

|||

|

The amount to be collected from the supplier has been accrued |

|||

|

Losses from defects are included in the cost of production (51,400 – 20,000 – 10,000) |

|||

The cost of internal correctable defects includes:

· the cost of raw materials and supplies used to correct the defect;

In practice, the question often arises as to whether it is necessary to restore VAT on the cost of material assets that were used in the production of defective products. Some experts believe that if the defective products are not subsequently sold, then the VAT previously accepted for deduction in the part attributable to the cost of inventory items used in the production of defective products must be restored and paid to the budget.

It is difficult to agree with this point of view. Let us remind you that in accordance with subparagraph 1 of paragraph 2 of Article 171 of Chapter 21 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), VAT amounts presented to and paid by the organization when purchasing goods on the territory of the Russian Federation necessary for carrying out transactions recognized as objects of taxation are subject to deductions. in accordance with Chapter 21 of the Tax Code of the Russian Federation. In addition, losses from defects for profit tax purposes are included in other expenses (subparagraph 47 of paragraph 1 of Article 264 of Chapter 25 of the Tax Code of the Russian Federation, therefore, despite the fact that part of the acquired inventory was used in the production of defective products, expenses for such materials are directly related to the sale of goods, that is, to transactions subject to VAT.

Consequently, in accordance with subparagraph 1 of paragraph 2 of Article 171 of Chapter 21 of the Tax Code of the Russian Federation, the deduction was made by the organization lawfully, and there is no need to restore the amount of VAT accepted for deduction in the part attributable to the cost of inventory items used in the production of defective products of the organization.

If the requirements of Article 252 of Chapter 25 of the Tax Code of the Russian Federation are not met, and therefore the cost of defective products cannot be recognized as expenses for the purposes of Chapter 25, then in accordance with subparagraph 2 of paragraph 1 of Article 146 of Chapter 21 of the Tax Code of the Russian Federation, such expenses are expenses for own needs, which are subject to VAT. At the same time, the organization retains the right to a VAT refund on material assets that were used to produce defective products in accordance with subparagraph 1 of paragraph 2 of Article 171 of Chapter 21 of the Tax Code of the Russian Federation.

In tax accounting, losses from defects are included in other expenses associated with production and sales on the basis of subparagraph 47 of paragraph 1 of Article 264 of Chapter 25 of the Tax Code of the Russian Federation. These expenses are indirect and are taken into account as expenses of the reporting period in full (clause 2 of Article 318 of the Tax Code of the Russian Federation). At the same time, among other expenses associated with production and sales, taken into account for the purpose of determining the tax base for corporate income tax, taxpayers have the right to include only those losses from defects in production that are not subject to recovery (withholding) from those responsible for the defects.

In order to recognize losses from marriage, it is necessary to comply with the requirements of Article 252 of Chapter 25 of the Tax Code of the Russian Federation. Let us recall that in accordance with paragraph 1 of Article 252 of the Tax Code of the Russian Federation, expenses for tax accounting purposes are recognized as justified and documented expenses incurred by the taxpayer, provided that they were incurred to carry out activities aimed at generating income.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form. Documented expenses mean expenses supported by documents drawn up in accordance with the legislation of the Russian Federation.

Organizations that apply a simplified taxation system in accordance with Chapter 26.2 of the Tax Code of the Russian Federation and have chosen “income reduced by the amount of expenses” as the object of taxation will not be able to include losses from marriage as expenses, since Chapter 26.2 of the Tax Code of the Russian Federation contains a closed list of expenses and expenses in the form of losses from marriage are not provided for in Article 346.16 of Chapter 26.2 of the Tax Code of the Russian Federation.

An external defect is one that is detected after the finished product has been shipped to the buyer.

Losses from external defects are reflected in the costs of the month in which claims from customers are received and accepted. Losses from defects that relate to products manufactured in previous periods are included in the cost of similar products produced in the current period. If such products are not produced in the current period, then these costs are distributed by type of product as general production costs.

Article 475 of the Civil Code of the Russian Federation establishes the following:

"1. If the defects of the goods were not specified by the seller, the buyer to whom the goods of inadequate quality were transferred has the right, at his own discretion, to demand from the seller:

proportionate reduction in the purchase price;

free elimination of product defects within a reasonable time;

reimbursement of their expenses for eliminating defects in the goods.

2. In the event of a significant violation of the requirements for the quality of the goods (detection of irreparable defects, defects that cannot be eliminated without disproportionate costs or time, or are detected repeatedly, or appear again after their elimination, and other similar defects), the buyer has the right to choose :

refuse to fulfill the purchase and sale agreement and demand the return of the amount of money paid for the goods;

demand the replacement of goods of inadequate quality with goods that comply with the contract.”

The cost of an irreparable external defect includes:

· production cost of products (products) ultimately rejected by the consumer;

· reimbursement to the buyer of costs incurred in connection with the purchase of these products;

· transportation costs for returning defective products;

· other costs associated with the production of defective products.

To ensure that the return of products is not qualified as its resale to the manufacturing organization, it is important to correctly draw up documents confirming the nature of the transaction. In this case, an act of identifying defects is drawn up (form TORG-2) and a claim is filed, which reflects the fact of delivery of low-quality products and indicates whether the supplier should transfer money to the buyer for defective products, or pay off the debt incurred after the return of defective products by shipping similar products of proper quality.

As a rule, external defects are detected not in the month when the products were manufactured, but later, when the rejected products are already included in the sales volume.

In the event of returning defective products, the supplier must reverse accounting transactions for sales in the share attributable to the defect, including the amount of accrued taxes.

The procedure for writing off external defects depends on the period when they were identified and on whether the organization creates a reserve for warranty repairs or not.

The cost of external correctable defects includes:

· costs of correcting defective products from the consumer;

· transportation costs for transporting products from the buyer to the manufacturer and back;

· other costs to reimburse the buyer for the purchase of products.

In the event that the manufacturing organization corrects a detected defect and then again delivers the product with corrected defects to the buyer, the following must be taken into account. Since the product has already been sold, ownership of it has passed to the buyer. Consequently, for the period during which these products are in the manufacturing organization and work is being carried out to eliminate defects, they must be accounted for in off-balance sheet account 002 “Inventory assets accepted for safekeeping.”

Example 4.

Let's change the conditions of example 3.

The organization sold a batch of 10 products. The selling price of one product is 23,600 rubles (including VAT 3,600 rubles). The cost of one product is 15,000 rubles.

During the use of the products, the buyer discovered defects in three products; the defects can be eliminated.

VAT reflected on transport costs

VAT is deductible

Losses from defects are included in the cost of production of the current period (1,000 + 3,000 + 5,000 + 1,300 + 1,000 – 8,000)

Features of accounting for income tax from the seller on returned low-quality goods.

The obligation to pay tax arises when the payer has an object of taxation. In accordance with Article 38 of Part One of the Tax Code of the Russian Federation, objects of taxation may be transactions for the sale of goods (work, services), property, profit, income, cost of goods sold (work performed, services rendered) or another object that has cost, quantitative or physical characteristics , with the presence of which the taxpayer’s legislation on taxes and fees associates the emergence of an obligation to pay tax. The sale of goods, works or services is recognized as the transfer on a reimbursable basis of ownership of goods, the results of work performed, the provision of services, and in cases provided for by the Tax Code of the Russian Federation - also on a gratuitous basis (clause 1 of Article 39 of the Tax Code of the Russian Federation).

When returning low-quality goods, there is no object of taxation, since the parties return to their original position: it is impossible to recognize the returned goods as sold, since we consider the buyer’s obligation to accept the goods unfulfilled. In addition, there is no mandatory sales criterion - consideration of the transfer, since the amounts paid are returned to the buyer.

Due to the fact that there is no object of taxation, therefore, there is no obligation to pay taxes, in particular income tax (clause 1 of Article 248 of Chapter 25 of the Tax Code of the Russian Federation).

It should be noted that at the time of shipment (transfer of goods from the seller to the buyer), the seller has no information about whether a certain volume of products will be returned or not. Therefore, an organization that determines income and expenses using the accrual method for the purposes of Chapter 25 of the Tax Code of the Russian Federation forms the tax base on the basis of primary documents as of the date of sale of goods.

But Chapter 25 of the Tax Code of the Russian Federation does not contain direct instructions on how to reflect the return of goods in tax accounting and how to take it into account when calculating the tax base for income tax.

In our opinion, the return of low-quality goods will depend on the period in which it is carried out. If the return of a low-quality product occurred in the same tax period as the sale, then the seller must reduce the amount of income from the sale, calculated in accordance with Articles 249 and 316 of the Tax Code of the Russian Federation, by the amount of the refund that the seller received for this product. And the amount of expenses of the current tax period should be reduced by the purchase price of the returned goods.

In addition, in tax accounting, losses from defects are included in other expenses associated with production and sales on the basis of subparagraph 47 of paragraph 1 of Article 264 of Chapter 25 of the Tax Code of the Russian Federation. These expenses are indirect and are taken into account as expenses of the reporting period in full (clause 2 of Article 318 of the Tax Code of the Russian Federation). At the same time, among other expenses associated with production and sales, taken into account for the purpose of determining the tax base for corporate income tax, taxpayers have the right to include only those losses from defects in production that are not subject to recovery (withholding) from those responsible for the defects, in compliance with the requirements of Article 252 chapter 25 of the Tax Code of the Russian Federation.

End of the example.

You can find out more about issues related to the specifics of accounting and tax accounting in production in the book of JSC “BKR-Intercom-Audit” “ Production».