Today, most firms, organizations and enterprises have switched to new-style cash register equipment. The introduction of cash registers with the function of online sending of fiscal data has made significant changes in the work of entrepreneurs: part of the reporting has been cancelled, new requirements have been established for conducting transactions through cash registers, penalties have been outlined for non-use or incorrect use of equipment. The changes also affected the check details.

In the case of fiscal memory, sales data was recorded on the device and then transferred by the entrepreneur to the tax service. Today, information is sent to the regulatory authority online. Firstly, this allows the tax inspectorate to reduce the number of inspections of enterprises, and secondly, the chances of businessmen providing falsified information are reduced to a minimum. To correctly transmit information to the online cash register, an intermediary is needed, which is the OFD. It is the operator who transfers all data to the endpoint. Since it is part of the data transfer scheme, information about the OFD is included in the list of required details of the cash receipt. In addition to this requirement, the details have undergone changes in other points, we will talk about this later.

Requirements for a cash register receipt

- Today there is no strict format in which checks should be generated, however, there is a list of details that in any case should be indicated on the check:

- Sign of the calculation made (return, expense, receipt);

- Information about the exact date, time and place of the operation;

- The tax system that the business owner has chosen for the enterprise;

- No. of the fiscal data storage device from the manufacturer;

- List/nomenclature of services provided or goods purchased;

- Final settlement indicating the amount;

- Amount of value added tax;

- How the buyer paid: cash, bank transfer;

- Data operator website;

- Cash document number;

- Cash register shift number;

- Buyer's phone number or e-mail if a virtual check was sent.

Having recorded an error in a check, representatives of the tax service may regard it as a failure to use cash register equipment of the established type. In order to correct the situation and prove his innocence, the entrepreneur will have to make every effort. The likelihood of a fine being imposed on the organization in this case is quite high. A businessman can find comprehensive information about legal requirements in the text of 54-FZ itself, in particular in Article 4.7 of the law.

It is worth noting that consumers also have the opportunity to control the correctness of registration of cash documents.

Name of goods in the receipt

Mandatory details of an online cash register receipt also include a list/nomenclature of services provided or goods purchased. However, this requirement does not apply to all owners of online cash registers. For entrepreneurs who have chosen the “simplified tax”, imputed tax and patent, there is a benefit in the form of deferment of indicating the product range on the receipt until February 1, 2021. If the government does not introduce new amendments to the legislation before the expiration of the benefit, these entrepreneurs will have to add information about the name of the product to cash receipts.

An exception in this case will be enterprises selling excisable goods. This segment of goods belongs to the category of those over which the state maintains special control.

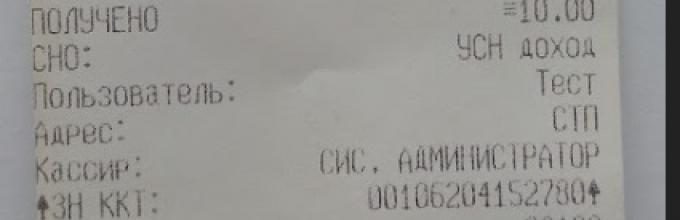

What is ZN in a cash register receipt?

The abbreviation ZN in a cash receipt indicates the serial number of the cash register itself. The serial number is assigned to the device immediately at the time of release by the manufacturer. The number is unique and cannot be repeated on multiple devices.

The serial number will be required by the businessman at the time of signing the contract with the OFD. An entrepreneur can find the necessary information on the body of the online cash register itself. If there is no ZN at the cash register, then the cash register device needs to be replaced. The fact is that in this case, the online cash register will be recognized as non-compliant with the requirements of the law; accordingly, the tax office may well issue a fine to the entrepreneur.

What is pH on a check?

The abbreviation stands for “online cash register registration number.” It is assigned at the time of device registration. The number is one of the required details for online cash register receipts in accordance with Order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ-7-20/229@. It is reflected not only in receipts, but also in cash reporting.

QR code

In addition to other details, cash register receipts now contain a type of data called a QR code. This type of detail is not required by entrepreneurs, but the law states that cash register equipment must have the function of indicating a QR code, regardless of whether this detail is printed on cash register receipts.

A QR code may be of interest to a buyer in two cases: when purchasing alcohol and when there is a need to check the entrepreneur’s integrity.

In the first case, the QR code will allow the consumer to check whether the alcoholic beverages purchased in the store are licensed.

In the second, the buyer can check whether information about the sale has been sent to the tax office.

- A QR code is a method of encrypting data. According to the law, it must contain the following information:

- Date, time of purchase;

- Serial number of the generated document;

- Sum;

- Number of the fiscal data storage device from the manufacturer.

Optional details

- The buyer's email or telephone number must be included in the receipt only if the virtual version is sent;

- The serial number of the cash register, although it is often entered by default;

- Advertising texts or appeal to the buyer;

- QR code, although there is an opinion that the situation may soon change.

There are cash receipt details that are not mandatory, for example:

Changes in checks

- Old style check

- Organization

- Serial number of KKT

- Document No.

- Sum

- Fiscal regime

- Online cash register receipt (from July 1, 2018 to 54 Federal Laws)

- Organization

- Serial number of KKT

- Document No.

- Information about the date and time of purchase

- Value with VAT

- Fiscal sign

- The specific location where the calculation was made. For example, in the case of traveling trade, the car number is indicated.

- Cash register shift number

- List of services provided or goods purchased

- Unit cost

- the total cost

- Selected tax system

- Payment method: cash/bank transfer

- Sign of the calculation made (return, expense, receipt)

- Message sign

- No. of the fiscal data storage device from the manufacturer

- Cashier details

- Contact details of the seller, if an electronic receipt was sent to the buyer

- Buyer data in case of sending an electronic check

- OFD website

- No. assigned to the cash register itself at the time of registration with the tax office

Sample of an online cash register receipt

- Name:

- Document;

- Document attribute;

- Product;

- Quantity;

- Cost per unit;

- Full price;

- Tax rate;

- Tax amount;

- Total amount;

- Payment method "cash";

- Payment method "non-cash";

- Tax system;

- VAT amount;

- Cashier details;

- Change;

- Organization;

- Address of the product of sale;

- Website for checking the correctness of a check;

- Check number;

- Date, time of formation;

- No. assigned to the cash desk itself at the time of registration with the tax office;

- Data sign;

- QR code.

Electronic check

An electronic check is absolutely identical to the paper version of the document. The virtual receipt of the online cash register contains the same details as the paper one. Moreover, it has the same legal force. Its main difference is the fact that the electronic check does not have to be transferred to the buyer without fail. It must be sent to the buyer's email or phone number

if the buyer has expressed a desire to receive it.

If the seller ignored the buyer’s request to send a check, and the buyer, in turn, sent a complaint to the Federal Tax Service, the entrepreneur will be fined.

A paper version of the receipt must be given to the buyer in any case.

New requirements for BSO

How can I check a buyer's receipt?

- The buyer can check the authenticity and correctness of the cash receipt in several ways:

- Visually assess the availability of the required details in accordance with 54-FZ

- Conduct a check using a special OFD program installed on the buyer’s gadget;

- Check the check using the Federal Tax Service program.

The buyer can carry out the actual verification using a QR code or payment information from a receipt.

What is a correction check under 54-FZ

According to 54-FZ, a correction check is a document for making adjustments. It is necessary when an amount of money is identified at the cash desk that is not included in the program. The situation may arise if the calculation was made at the time of a power outage, network failure, etc. A note with a detailed justification should be kept with the document.

What is a refund check

- A refund check is a document that the cashier generates in two cases:

- The buyer has decided to return the goods;

- If the cashier punched the check incorrectly and discovered the error in the presence of the buyer.

There is no need to create a correction check, since nothing actually needs to be corrected.

Fines

If an entrepreneur issues checks with incorrect details to customers, the tax office may make a claim to the entrepreneur in accordance with clause 4 of Art. 14.5 of the Code of Administrative Offenses of the Russian Federation, however, today there is no article in the Code of Administrative Offenses regulating fines for incorrect details on a check. Accordingly, you can file a complaint with the Federal Tax Service. Another question is whether an entrepreneur needs “friction” with the tax office, especially since there are deficiencies in the execution of cash receipts.

up to 2000 rubles

will amount to a fine for individual entrepreneurs if checks are not issued to customers

up to 10,000 rubles

will amount to a fine for the LLC if checks are not issued to customers

Entrepreneurs have every chance to avoid penalties from the tax office. To do this, it is necessary to comply with all legal requirements when carrying out the activities of the enterprise. If the question concerns cash receipts and related details, here the issue is also resolved quite simply. Almost all standard cash register equipment and software for it comply with legal requirements by default.

The only exceptions will be devices that are not included in the register of cash registers. An entrepreneur should not purchase such devices, even if their price is several times lower than that of the original product. The desire to save money on the purchase of cash register equipment can result in both a fine and the deprivation of an entrepreneur’s license if particularly serious violations are detected.

Question answer

Which check should I punch if the buyer makes an advance payment?

It is necessary to generate a cash document indicating the full amount of the advance, with the calculation indicator “advance”.

When can you not indicate VAT on a receipt?

The tax rate may not be indicated on the check if the entrepreneur is exempt from it.

There are a lot of questions with the new checks. After entering, some stores incorrectly generate documents or do not indicate required fields. The tax office fines you for this. To prevent you from running into a fine, we have collected all the new details and requirements in this article. We also prepared a sample check in two versions - paper and electronic.

We'll tell you which cash register from our catalog is suitable for your business.

Leave a request and receive a consultation within 5 minutes.

Requirements for an online cash register receipt and 18 new fields

The client chooses which document he will receive: paper, electronic or both. The paper one, as before, is printed on, and the electronic one is sent to the client by mail or SMS. The contents of both types of checks are the same and differ only in a few details.

This message comes to your phone

Previously, there were 7 mandatory fields in fiscal documents, but after introducing new ones, there were 25. But for different types of activities, the number of mandatory details may increase or decrease.

- The name of the document - for example, “cash receipt” or “shift closing report.”

- Name of the organization or full name of the entrepreneur.

- Cashier - position and surname (not indicated for automatic payments on the Internet and vending).

- Document number for the shift.

- Date and time of payment.

- Place of payment:

- postal code and address where the cash desk is located;

- if you trade on the road - the model and state number of the car, the address of the LLC or the registration address of the individual entrepreneur;

- when working on the Internet - the site domain.

If you moved the cash register to another store, re-register it at the new address. Otherwise, the company will be fined 5,000–10,000 rubles, and the individual entrepreneur 1,500–3,000 rubles.

- Shift number.

- Name of goods or services.

- Price including discounts.

- Quantity and cost of goods.

- VAT rate and amount.

- Taxation system (for example, “patent” or “STS income”).

- Calculation form. How the client pays: in cash or electronic money (card, Qiwi, Webmoney, Yandex.Money).

- Payment amount - how much was paid in cash and how much electronically.

- Calculation sign:

- arrival (client paid);

- return of receipt (the client returned the goods, and you gave him money);

- expense (for example, they gave out a lottery winnings);

- return of expense (the client returns the amount received).

- Fiscal sign of the message (when the check is sent to the OFD).

- The fiscal sign of the document is generated by the drive.

- Drive serial number.

- Registration number of the cash register, which was issued by the tax office.

- The number of the document under which it is stored in the storage device.

- Client's phone number or e-mail (when sending an electronic check).

- The company's e-mail if a check is sent to the client by mail.

- The tax website address is www.nalog.ru.

- QR code.

If you live in a hard-to-reach area, some check details are optional for you. You do not have the ability to send documents over the Internet, so you don’t have to indicate the address of the tax office website, your email and the buyer’s contacts.

To compare old and new check fields, download them.

If at least one required detail is missing, the check is invalid. This is equivalent to the fact that you did not issue a payment document at all. The company will be fined 10,000 rubles, and the entrepreneur 2,000 rubles.

Document printed on an online cash register

Electronic check

To receive an electronic receipt, the client says his mobile number or email before paying. Such a document is equivalent to a paper one and replaces it.

Electronic payment document

If the buyer did not provide a number or email address, issue a paper check. If you punch a fiscal document, but do not hand it over and send it to the client, you will be fined.

Check verification service - application from the Federal Tax Service

The Federal Tax Service has released a mobile application. Through it, the buyer checks fiscal documents for authenticity. If they are illegal, the client can immediately complain to the tax office.

1. Ask our specialist a question at the end of the article.

2. Get detailed advice and a full description of the nuances!

3. Or find a ready-made answer in the comments of our readers.

There are two ways to check your receipt:

- manually enter the fiscal attribute, time of purchase, amount, document number and transaction type (expense, receipt);

- read a QR code from a paper receipt.

The application will compare the information entered by the client with that received by the tax office from the OFD. If the data differs, the Federal Tax Service will look into it.

Application for checking receipts

Strict reporting form = cash receipt

Now BSO and check are one and the same. They are equal in value, contain identical fields, and look identical. The strict reporting form can be sent to clients electronically. A copy of the BSO is sent to the OFD.

Forms can only be printed at the checkout counter and not at a printing house or printer. By law, BSOs must be formed on a special automated system. But the tax office said that you can use the regular one.

-

Popular questions about checks and 54-FZ

What is a correction check under 54-FZ?

According to 54-FZ, the correction check is processed if there is a shortage or, conversely, an excess amount at the checkout. For example, the cashier ordered an item for 1,000 rubles. instead of 800. If an error is discovered at the end of the shift, run a correction check. In the attribute, indicate “receipt” for 200 rubles. (1000 - 800). At the same time, the cashier writes a memo and explains the reasons for the correction.

If you find an error after a few days, also fill out a correction check. For example, on June 13, correct the error for the 7th.

If you notice an error immediately or the buyer returns the product, do not generate a correction receipt. In this case, try “return receipt”.

Sample of a correction receipt printed on a new cash register

When can you omit VAT?

If you work without a VAT rate, do not indicate it or write “0%”. Courier services may not write VAT, since they do not sell goods, but only deliver.

Is it possible not to indicate the name of the product?

Until January 1, 2021, the name of the product or service is not indicated by the individual entrepreneur on the simplified document, patent, UTII and UST. Only if they do not sell excisable goods.

The name is not written if the exact list of goods and their volume is unknown at the time of payment, for example, when making an advance payment.

What kind of check do payment agents issue?

Paying agents indicate in the documents everything that should be on any seller’s check. Even the name of the product. Therefore, online stores and courier services will have to connect their bases. In addition to standard fields, agents specify additional fields:

- the size of your commission;

- telephone number of the agent, supplier and operator who accept the payment.

How to write a check for an advance payment?

If the client makes an advance payment, punch the document with the “Advance” sign. Do not indicate the product name, price and quantity if the volume and list of goods cannot be determined. For example, at the time of payment, the buyer does not know exactly how much product he needs. This was stated in a letter from the Ministry of Finance.

In the final receipt, indicate how much the client contributed upon full payment. Do not indicate an advance.

Examples of documents for an advance payment (for convenience, some details are not shown)

What is the penalty for errors on a check?

For individual entrepreneurs - 1,500–3,000 rubles, LLC - 5,000–10,000 rubles. Small and medium-sized businesses may be issued a warning if this is their first violation.

The new law on the use of online cash desks ensures transparency of the financial activities of entrepreneurs operating in the field of trade. Also, innovations are designed to protect the rights and interests of consumers, since checks now contain a large amount of information. What an online cash register receipt looks like, and what details it must contain, are approved by Order of the Federal Tax Service dated March 21, 2017 No. ММВ-7-20/

Where to buy an online cash register

Types of checks

According to the new amendments to Federal Law No. 54-FZ, new generation cash register equipment must generate two types of receipts:

- Paper.

- Electronic.

They differ from each other only in format. The information and content are identical.

Paper check

This document is issued to the buyer without fail when making payments at the checkout. Failure to issue an online cash register receipt entails the imposition of penalties on the responsible person (seller or cashier).

The buyer can also check the legality of the purchased products and the validity of the excise tax by scanning a special QR bar, which is included in each receipt.

How to check the authenticity of a cash receipt:

- Install a mobile application on your smartphone or tablet to check your receipt. You can download it on the official website of the Federal Tax Service or through the App Store and Google Play services.

- Login to the application.

- Point your phone to the QR bar and scan it.

- The resulting result should contain the following information:

- payment amount;

- date and time of calculation;

- payment indicator (arrival or return);

- document serial number;

- serial number of the fiscal drive.

Using this function, the consumer can find out about the legality of the organization’s activities, check the integrity of the seller, and if there are complaints, report violations to the tax office.

Electronic check

This type of document is issued at the request of the consumer.

How to get it:

- When making a purchase, notify the cashier that you would like to receive a copy of the receipt in electronic format.

- Provide the seller with a phone number or email address.

- The download link will be sent to you via SMS or email.

The details provided by law must be reflected in a fiscal document of this type, regardless of its execution (in paper or electronic form). If at least one of the requirements is missing, the check is invalid. In this case, the financial settlement operation may remain unaccounted for by the tax office, which leads to the imposition of penalties for violation of the law.

Online cash register receipt sample

The legislation of the Russian Federation does not provide for a single unified form and type of online cash register receipt. Issued by different devices, they may differ in appearance. But the information contained in them must comply with established rules.

A paper check issued by an online cashier should look something like this.

The electronic receipt of the online cash register will look like this.

The law allows you to add additional details to the check at the request of the entrepreneur. This could be a trademark or information about discounts and promotions, an appeal to customers, etc.

Information in the receipt issued online by cash register

Modern fiscal payment documents contain a large amount of information. If previously there were 7 points among the mandatory cash register details, now there are 24 of them. The prescribed data is not always clear to customers. Also, sometimes people get lost, not knowing where exactly to look for the required details and how to decipher them, so you should take a closer look at the information that is printed on the online cash register receipt.

Important! Since there are no uniform requirements for unifying the form of a check, the details in different checks can be swapped and indicated in different places.

What information should be included is shown in the table below.

| No. | Details and information | A comment |

| 1 | Title of the document | The document may state that this is a cash receipt, a shift opening report, or a shift closing report. |

| 2 | Individual entrepreneur or legal entity data |

|

| 3 | Place of settlement | Specified as:

|

| 4 | Document serial number | Every day the numbering is updated, and the countdown begins anew with the opening of the shift |

| 5 | Date and time of the operation |

|

| 6 | Shift number and details of the seller or cashier | The position and full name are registered |

| 7 | Settlement transaction indicator | Most often, 4 types of operations are indicated:

|

| 8 | Information about the product sold or service provided |

|

| 9 | Total purchase amount | The following data is indicated:

|

| 10 | Type of calculation | Cash or electronic payment |

| 11 | Information about cash register equipment | This block contains the following information:

|

The data given in the table must be reflected in the online cash register receipt. But every rule has exceptions.

A certain group of individual entrepreneurs, namely those who are on PSN, UTII, USN, Unified Agricultural Tax, may not yet indicate the name and quantity of goods in the online cash register receipt. This obligation for them will come into force on 02/01/2021. Currently, excisable goods are an exception to this rule.

The best offers in price and quality

For areas remote from civilization, where communication is poor and the Internet is not supported, you do not have to indicate the serial number of the check in the online cash register and the e-mail address of the seller or buyer if he asks to send him a payment document in electronic format. The list of such localities is approved by law by the Federal Tax Service.

Information about the cashier or seller may not be on the receipt if payments were made using automatic devices or via the Internet.

Additional details

In addition to basic information, the online cash register receipt may contain additional details. There are details that may be on the check, but their mandatory presence is not required by law. Also, the entrepreneur, at his own discretion, has the right to include additional information in fiscal documents.

Such information includes:

- Buyer's email address or phone number. Such data is included if the consumer wishes to receive an electronic version of the receipt.

- The seller's email address, if he sent an electronic check to the buyer.

- QR code with encrypted information. The buyer, if he has a special application, can scan it and receive the necessary information after decryption. Federal Law No. 54 Federal Law does not clearly state the requirement that this code be contained in a fiscal document. But in the section of requirements for cash register equipment of the same law it is stated that online cash registers of the new generation must be able to print a two-dimensional bar code in a specially designated area. This means that the QR code may be contained in the online cash register receipt, or it may not be contained in the printout.

- The serial number of the automatic device must be indicated on the receipt if payments are made through this device.

- The amount of remuneration of the paying agent and his telephone number in the case when settlements occur not directly with the seller, but through intermediaries.

- Additional information, if required: company logo, information about discounts, clarification of promotion conditions and other attributes.

Responsibility for incorrect data in an online cash register receipt

For violation of legal requirements that indicate what should be in an online cash register receipt, penalties are provided, regulated by Article 14.5. Code of Administrative Offenses of the Russian Federation (Code of Administrative Offences). The absence of any item from the list of required details will be regarded as conducting illegal activities, since the check will be invalid.

Administrative fine for the absence of at least one of the required details:

- For citizens – from 1500 to 2000 rubles.

- For officials - from 3,000 to 4,000 rubles.

- For legal entities – from 30,000 to 40,000 rubles.

Important! Sometimes, if a non-serious violation is detected, an enterprise can get away with a warning.

Responsibility for refusing to send an electronic payment receipt at the buyer’s request entails punishment in the form of a warning or an administrative fine in the amount of:

- 2000 rub. on officials;

- 10,000 rubles for legal entities.

Thus, it will be easier and cheaper to immediately set up the correct seal so that the online cash register receipt contains what is specified by law, than to pay fines later.

In February 2017, the country's authorities adopted a new law, which partly made it more difficult for organizations to do business. Significant questions regarding cash registers began to be raised more often.

The authorities have always demanded open business and welcomed such behavior. However, entrepreneurs often hid the profits they received from sales, which led to the introduction of the new 54-FZ. It provides for the introduction of cash register equipment. Not only will entrepreneurs now always be under the control of the tax inspectorate, but the requirements for sales receipts have become more stringent.

According to Law 54-FZ, the name of the product has become a new mandatory detail in the issued check. The cash register should now be set to name stamp goods in the receipt 54-FZ. Also, the buyer himself can track all the necessary details provided for by the new legislative draft. If a violation is detected, the buyer has every right to complain to the store and receive compensation in the form of money.

System of fines for the absence of a product name in a receipt under 54-FZ

In addition to new amendments that relate to the operation of cash register equipment, checks and fiscal drives, the legislative branch has developed a certain system of fines for violating the rules for printing mandatory details on a check. In case of detection of non-compliance with the requirements, the following persons will be punished: legal entity. person, official and individual entrepreneur. However, there are flexible changes for some individual entrepreneurs. More on them a little later. As for the fine system, all these persons must pay certain amounts of money for breaking the law using a cash register. For officials, a fine of 1000-3000 rubles is provided, and for organizations - 5000-10000 rubles.

The legislative branch was loyal to some individual entrepreneurs and made it easier for them to conduct business without violating the new law. Organizations that work on the patent PSN, simplified tax system, unified social tax and UTII have the legal right not to enter the required details - Name of product, provided 54-FZ, and thereby not even break the law. However, not everything is as good as it seems. This deferment for some individual entrepreneurs lasts until 2021, after which they are required to switch to printing the product range on the receipt. These exceptions in the form of deferment do not apply to other organizations. So if your organization is no exception and works with new cash registers, then you will have to bear the penalty if you break the law.

Read also

This year there are a lot of changes in the work rules of absolutely all entrepreneurs due to the edition of Federal Law-54, which forces everyone to use new generation online cash registers that are capable of transmitting information to the Federal Tax Service in real time.

Cashier's check. Everyone held this piece of paper in their hands. Kilometers of cash register tape, cut into millions of receipts, pass through the hands of customers every day. What information does the check tell us? What must be printed on it without fail, and what is the imagination of the store owners? In our country, the area of operation of cash register equipment is subject to several regulatory documents. The State Register of Cash Register Equipment answers the question of which cash registers can be used in which case. This document is constantly updated and supplemented. This is carefully monitored by the Ministry of Industry and Trade of the Russian Federation. According to this provision, the areas of application of cash register equipment are divided into areas of application: trade, services, trade in petroleum products and gas fuels, hotels and restaurants.

What should be on a cash receipt?

The information required to be placed on a cash register receipt is defined in the Regulations on the use of cash registers when making cash settlements with the population, approved by Decree of the Government of the Russian Federation dated July 30, 1993 No. 745, as amended by Decree of the Government of the Russian Federation dated August 7, 1998 No. 904. These are:

- name of the organization or entrepreneur (individual entrepreneur, surname, initials);

- serial number of the cash register;

- serial number of the check;

- date and time of purchase (service provision);

- cost of purchase (service);

- a sign of a fiscal regime.

In addition to these details, additional mandatory details have been defined for various areas of CCP application. They are listed in the GMEC decision (minutes No. 14 of November 10, 1994, letter No. AO-7-272 dated November 28, 1994, as amended on December 19, 2002) and in the GMEC decision dated December 27, 95 (minutes No. 9/25-95, letter dated January 30, 1996 No. 26-1-06 as amended on June 24, 2003).

Additional mandatory details of a cash receipt in the trade sector are:

- the amount received from the buyer and the change amount;

- section (department) identifier – except for portable cash registers;

- name or code of the product, code (identifier) of the cashier - except for autonomous cash registers;

- type of payment (cash, non-cash (payment card), indirect non-cash (for example, coupons), mixed) - only for fiscal registrars.

In the service sector:

- the amount deposited by the client and the change amount - only for active cash registers and financial markets;

- name or service code – for all cash registers;

- code (identifier) of the operator (cashier) - except for autonomous cash registers;

- Section (department) identifier, payment type, account number - only for FR.

- brand of petroleum product, quantity;

- operator identifier (number),

- number of the dispensing valve or fuel dispenser,

- type of payment,

- card number for non-cash payment,

- the amount paid by the buyer and the change amount for cash payment,

- field for marking the number and amount of the correction check.

In hotels and restaurants:

- account number, waiter (receptionist) code, type of service or department, name (code) of the dish (service) - for all cash registers;

- amount deposited by the client, change amount, type of payment - only for FR.

What should you consider when selecting information when printing on a receipt?

All other details are optional. What should you consider when selecting information when printing on a receipt? Probably, first of all, the needs of the buyer. And he often needs to provide a cash receipt to confirm the fact of purchasing a product or service to the tax authorities or his employer. In this case, as a rule, a detailed description of the purchased product or service is required - name and quantity. The same information helps the buyer make sure that the payments made to him at the checkout are correct. When loyalty systems are used in a store, information about the discounts or bonuses provided is almost always printed on the receipt. Many stores print additional advertising information on the cash register receipt - announcements of discounts and sales, information about vacancies, and other appeals to customers.

The technical capabilities of modern cash registers limit the imagination of their owners only by the width of the cash register tape. Today there are three standard tape sizes - 44 mm, 57 mm and 80 mm. When choosing a cash register, pay attention to this parameter. As a rule, the cost of consumables and the device itself also depends on it. For a small store, the cost of a cash register tape (from 10 to 40 rubles per roll, depending on the width) is unlikely to be noticeable, but for large chain enterprises this is a significant expense item. Knowing the average length of each cash receipt and the number of receipts, it is easy to calculate the increase or decrease in expenses from changes in the volume of information displayed.